As a business owner or independent contractor, navigating the complexities of tax compliance can be a daunting task. One crucial aspect of this process is obtaining a completed W9 form from freelancers, vendors, or independent contractors you work with. The IRS W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a critical document that verifies the identity and tax status of these individuals or entities. To simplify this process, Lawrina offers a free IRS W9 form template that you can download in PDF format, making it easier to manage your tax obligations.

What is the IRS W9 Form?

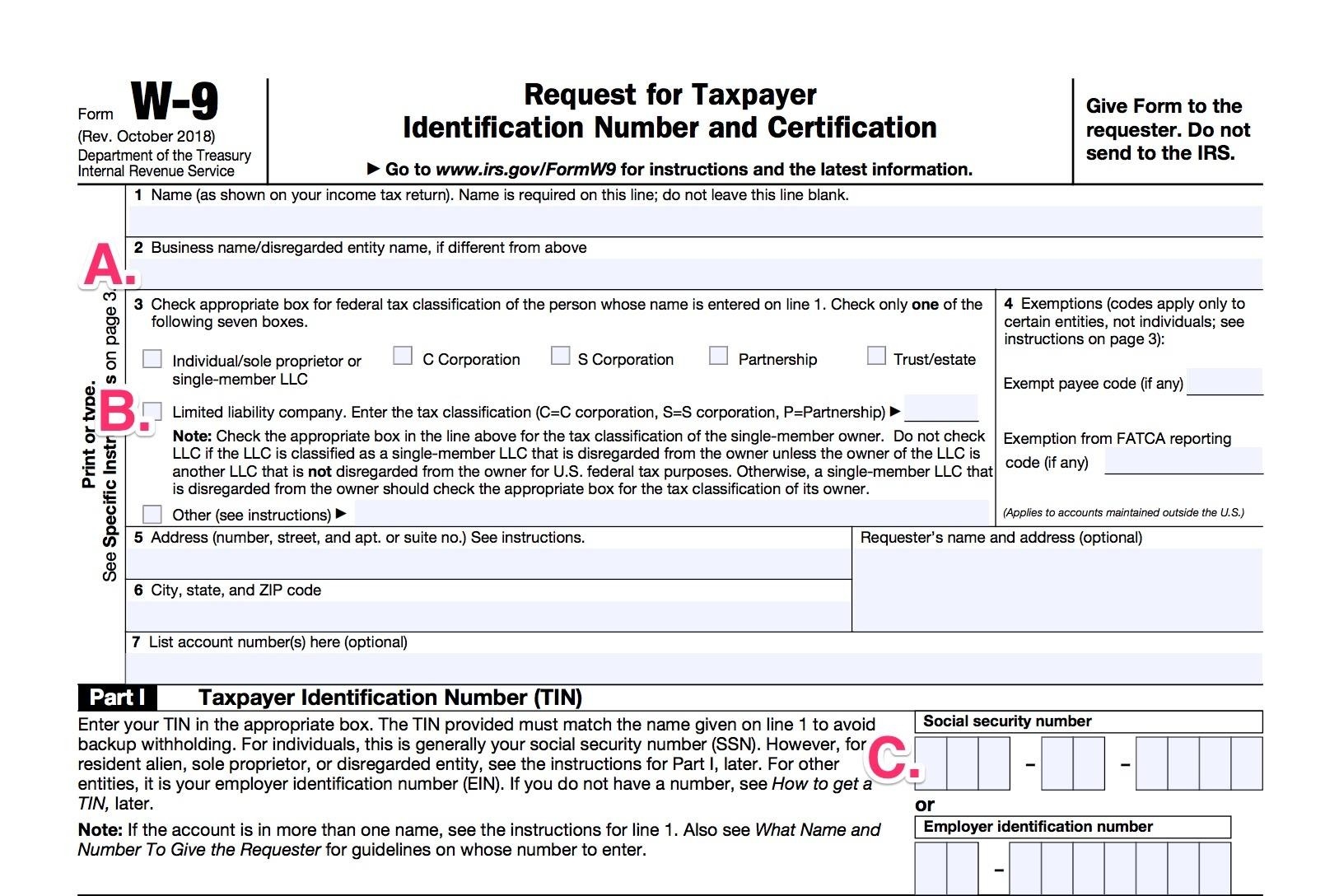

The IRS W9 form is a standard document used by businesses to collect necessary information from freelancers, independent contractors, and vendors. The form requires the provider to furnish their name, business name, address, taxpayer identification number (such as a Social Security number or Employer Identification Number), and certification regarding their tax status. This information is essential for completing tax returns and ensuring compliance with IRS regulations.

Why Do You Need an IRS W9 Form?

Businesses need an IRS W9 form for several reasons:

Tax Compliance: The W9 form helps businesses verify the tax status of freelancers and independent contractors, ensuring they comply with IRS regulations.

Accurate Tax Reporting: The information provided on the W9 form is used to complete tax returns and report payments made to freelancers and independent contractors.

Avoid Backup Withholding: Businesses must obtain a completed W9 form to avoid backup withholding, which can result in significant financial penalties.

Benefits of Using Lawrina's Free IRS W9 Form Template

Lawrina's free IRS W9 form template offers several benefits, including:

Convenience: The template is easily accessible and can be downloaded in PDF format, making it simple to share with freelancers and independent contractors.

Accuracy: The template ensures that all necessary information is collected, reducing the risk of errors or omissions.

Compliance: By using Lawrina's W9 form template, businesses can ensure they are meeting IRS regulations and avoiding potential penalties.

How to Download and Use Lawrina's Free IRS W9 Form Template

To access Lawrina's free IRS W9 form template, follow these steps:

1. Visit Lawrina's website and navigate to the W9 form template page.

2. Click on the "Download" button to obtain the template in PDF format.

3. Share the template with freelancers and independent contractors, either by email or through your company's online portal.

4. Once completed, store the W9 forms in a secure location, such as a digital filing system or a locked cabinet.

By utilizing Lawrina's free IRS W9 form template, businesses can streamline their tax compliance process, reduce errors, and ensure they are meeting all necessary IRS regulations. With its ease of use, accuracy, and convenience, this template is an essential tool for any business working with freelancers or independent contractors.