Understanding the Evolution of Prices in the United States: A Historical Consumer Price Index (CPI) Analysis from 1913 to 2025

Table of Contents

- Cpi Index Jan 2024 - Image to u

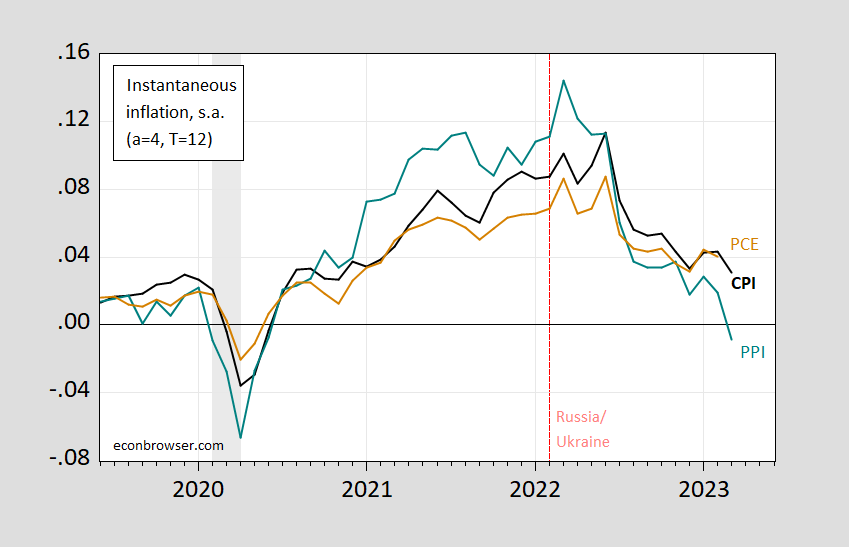

- Charts of the Week: Inflation Alarm - Haver Analytics

- The August CPI Chart Stock Market Bears Don't Want You To See | Seeking ...

- Peluang Trading Fundamental USD Selasa 17 November 2015 - Lab Forex

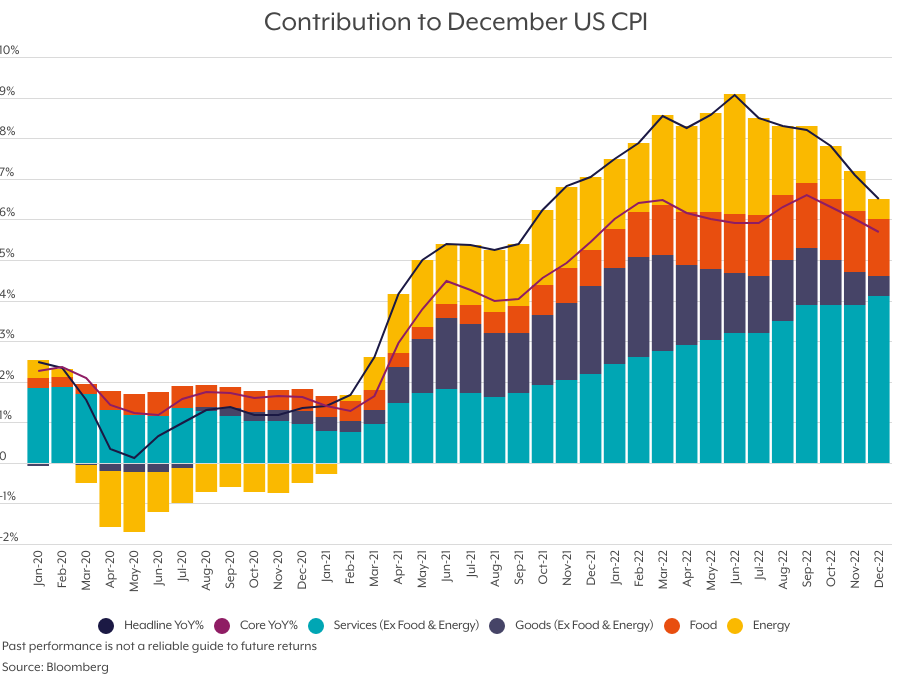

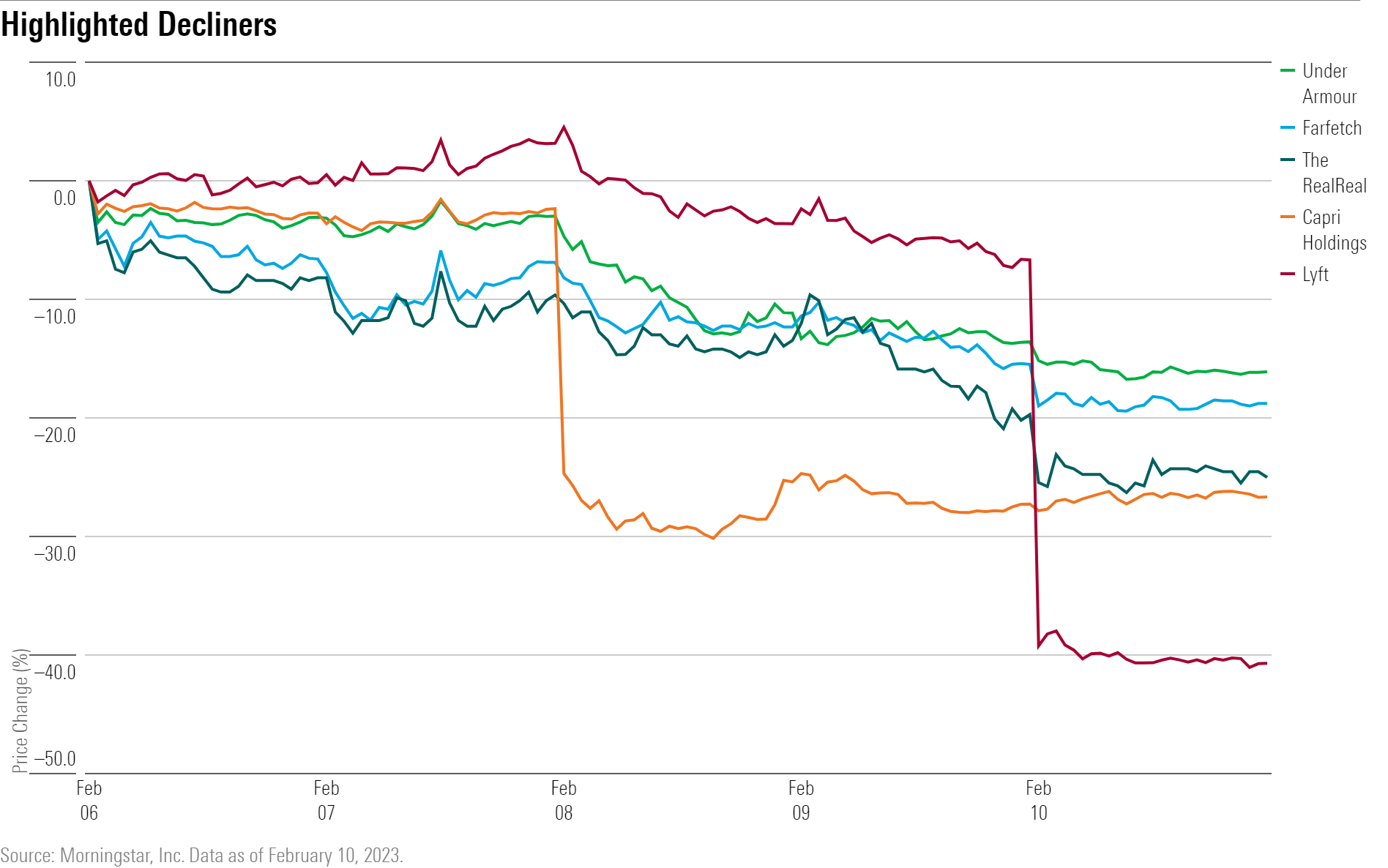

- Investment Bulletin: January 2023 - Find a Wealth Manager

- The August CPI Chart Stock Market Bears Don't Want You To See | Seeking ...

- Core Cpi June 2025 - Effie Halette

- Gambar 1. Asean CPI 2020 Sumber: TII 2021 | Download Scientific Diagram

- Core Cpi June 2025 - Effie Halette

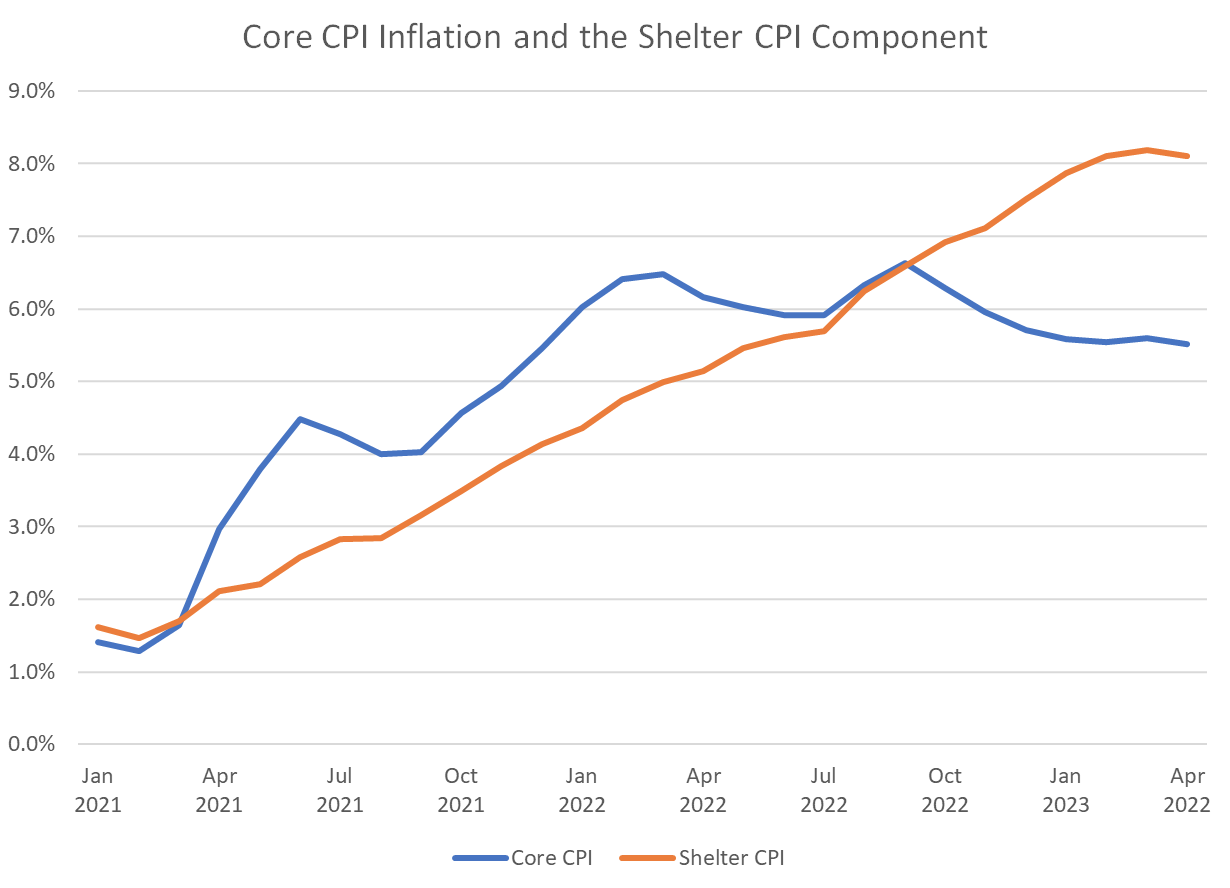

- Markets Brief: January CPI Report Forecasts Show a Bump in the Road to ...

Introduction to the Consumer Price Index (CPI)

Historical CPI Data: 1913 to 2025

Implications and Insights

The historical CPI data provides valuable insights into the evolution of prices in the United States. Some key takeaways include: Inflation has been a persistent feature of the US economy, with some periods experiencing high inflation rates. The CPI has been influenced by various economic events, including wars, recessions, and policy changes. The index has been used to inform monetary policy decisions, such as adjusting interest rates to control inflation. Understanding the historical CPI data can help consumers, businesses, and policymakers make informed decisions about investments, pricing, and resource allocation. The historical Consumer Price Index (CPI) data from 1913 to 2025 offers a fascinating glimpse into the evolution of prices in the United States. By analyzing the CPI data, we can gain insights into the country's economic trends, inflationary pressures, and policy responses. As the US economy continues to grow and evolve, the CPI will remain a vital tool for measuring inflation and informing economic decisions. Whether you're a consumer, business owner, or policymaker, understanding the historical CPI data can help you navigate the complexities of the US economy and make informed decisions about the future.This article is for informational purposes only and is not intended to provide investment or economic advice. The historical CPI data is subject to revision and may not reflect the current economic situation.