As we delve into the second quarter of 2024, economic indicators are under scrutiny to gauge the health and direction of the global economy. One crucial metric that provides insight into inflationary trends and consumer spending power is the Consumer Price Index (CPI). In this article, we will explore the

PDF Consumer Price Index for April 2024, as analyzed by EY, to understand its implications and what it signifies for consumers, businesses, and policymakers alike.

Introduction to Consumer Price Index (CPI)

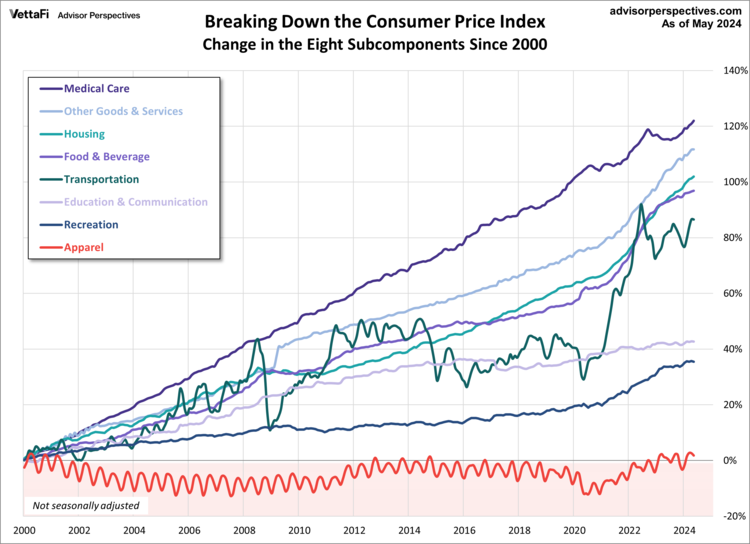

The Consumer Price Index is a statistical measure that tracks the weighted average of prices of a basket of goods and services consumed by households. It is a key indicator of inflation, which is a sustained increase in the general price level of goods and services in an economy over time. The CPI is widely used by central banks and governments to formulate monetary and fiscal policies aimed at controlling inflation and promoting economic stability.

EY's Analysis of CPI for April 2024

EY, one of the world's leading professional services firms, provides comprehensive analyses of economic trends, including the Consumer Price Index. Their

PDF report on the CPI for April 2024 offers detailed insights into the current state of inflation, highlighting sectors that have seen significant price increases and those that have remained stable or seen decreases.

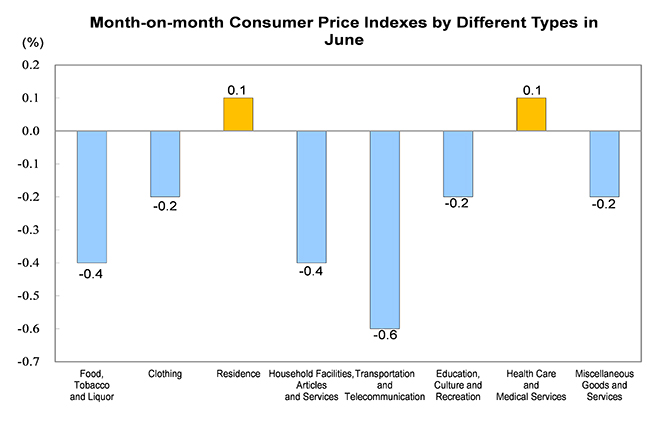

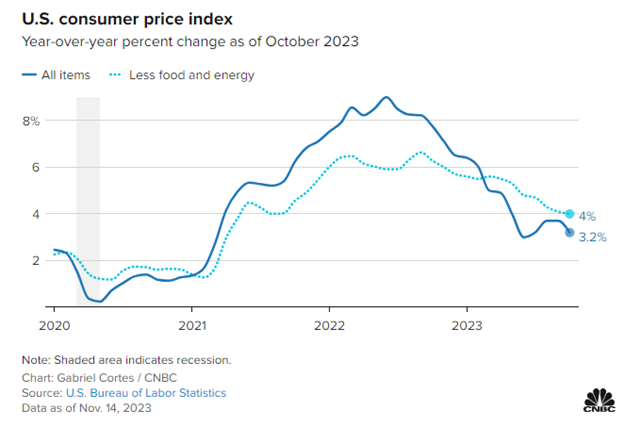

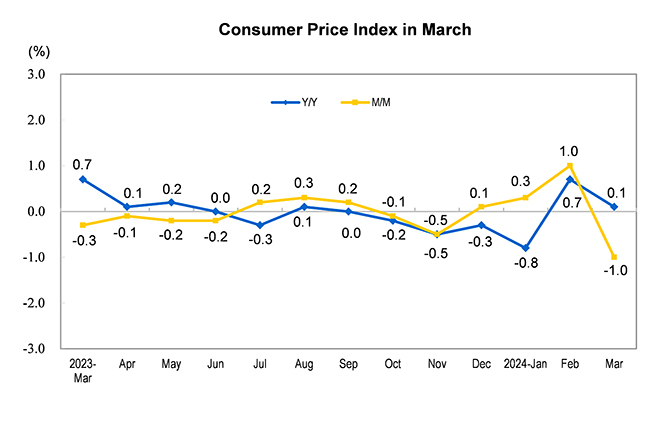

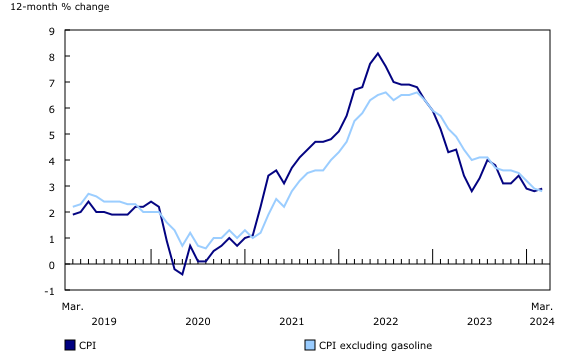

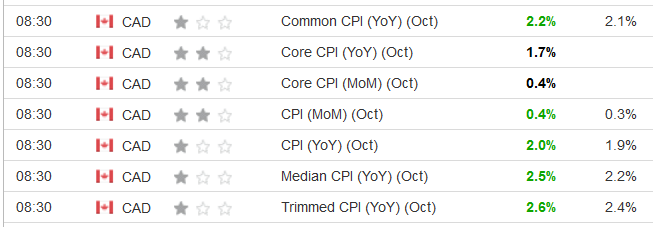

According to EY's report, the CPI for April 2024 indicates a [insert percentage]% increase in consumer prices compared to the same period last year. This change reflects fluctuations in the prices of food, housing, apparel, transportation, and other goods and services. EY's analysis also points out that certain sectors, such as energy and healthcare, have been primary contributors to the inflation rate due to [briefly mention the reasons, e.g., global demand, supply chain issues, etc.].

Implications of the CPI Report

The implications of the April 2024 CPI report are multifaceted:

-

For Consumers: An increase in the CPI means that the purchasing power of consumers is reduced. As prices rise, the same amount of money can buy fewer goods and services. This can lead to decreased consumer spending, especially on non-essential items, as households try to adjust their budgets to accommodate higher prices.

-

For Businesses: Businesses face increased production costs due to higher prices of raw materials and labor. While some businesses may pass these costs on to consumers through higher prices, others may absorb the costs, potentially reducing their profit margins. The CPI report can help businesses make informed decisions about pricing strategies and investment plans.

-

For Policymakers: The CPI is a critical tool for policymakers in setting interest rates and regulating the money supply to control inflation. A high inflation rate may prompt central banks to increase interest rates to curb borrowing and spending, thereby reducing demand and easing price pressures.

The

PDF Consumer Price Index for April 2024, as analyzed by EY, provides valuable insights into the current inflationary trends and their impact on the economy. Understanding these trends is essential for making informed decisions, whether you are a consumer looking to manage your household budget, a business owner navigating market fluctuations, or a policymaker tasked with ensuring economic stability. As the global economy continues to evolve, keeping abreast of the latest CPI data and analyses from reputable sources like EY will be crucial for navigating the challenges and opportunities that lie ahead.

For more detailed information and to access the full

PDF report, visit EY's official website or consult with their economic advisory team. Staying informed about economic indicators like the Consumer Price Index is the first step towards making strategic decisions in an ever-changing economic landscape.

Insight/2024/10.2024/10.09.2024_CPI/02-consumer-price-index-median-estimate-12-months.png?width=2016&height=1152&name=02-consumer-price-index-median-estimate-12-months.png)

Insight/2024/11.2024/11.12.2024_CPI/02-consumer-price-index-yoy-nsa-versus-median-estimate-12-months.png?width=1344&height=768&name=02-consumer-price-index-yoy-nsa-versus-median-estimate-12-months.png)